Two virus relief packages have passed Congress and been implemented, each running slightly in excess of $1 trillion. They provided a $600.00 per week federal supplement to state unemployment benefits, so generous that a majority of workers on unemployment received more money than if they were working. That federal supplement expired at the end of July, and extensive negotiations occurred between the Administration and the Democrats over an extension and other pandemic relief.

The Administration was unable to reach agreement with the Democrats, and much of the disagreement coming over the monetary size of the third package, the Democrats wanting some $3.4 trillion, and extension of the federal unemployment supplement to at least the end of the year, and additional aid to state and local governments, and others. The Republicans were pushing for employer protection from lawsuits resulting from workplace Coronavirus, as long as they make reasonable efforts to follow public health guidelines and did not commit acts of gross negligence or intentional misconduct. The Republican legislation includes an expanded version of the employer retention tax credit for businesses that keep workers on their payrolls.

With no end in sight in the negotiations between Administration and the Democrats, President Trump on August 8, 2020 issued a set of executive actions providing economic relief for the pandemic. The executive actions would reduce the $600.00 supplement in unemployment compensation that expired in July to $400.00, or $300.00 in the case of states that are unwilling to add the remaining $100.00 from their own budgets. The new plan would cover weeks of unemployment insurance from August 1 through December 27, 2020, or when the government's Disaster Relief Fund balance drops to $25 billion, whichever occurs first. This means that under the unemployment laws of many states, those states will be paying approximately $700.00 per person per week.

Another action gives federal housing officials broad discretion to prevent evictions. The third action would defer payroll tax payments for people making less than $100,000.00 a year. This deferral applies only to the employee's share of Social Security taxes (6.2%) and only for the period September through December. The fourth part of the President's executive actions related to student loan relief.

Treasury Secretary Mnuchin said there will be no cuts to Social Security from the deferred payroll tax collection, and that Social Security benefits would be paid from the general federal budget. On August 11, 2020, Secretary Mnuchin expressed the Administration's call for Congress to forgive the payroll tax liabilities that President Trump deferred, and that the Treasury is working on guidelines for the payroll tax deferral. At the same time, he indicated that the delayed levies that fund Social Security would be optional for companies to implement, rather than mandatory. This means that employers must decide whether to change paycheck withholding.

Employers must decide how they will deal with the payroll tax deferral issue and some may explain their decisions to employees. The President's executive action provides that payment of the taxes is deferred not waived. Employees may be expecting the deferred taxes to be in their paychecks, but employers have the obligation to withhold and pay the taxes. If some employers do not withhold the taxes and do forward the money to employees, employers may have to pay the taxes later if Congress does not act to waive collection of those taxes. If employers want to recover the money from employees next year, employers should explain to employees that the payment is merely an advance that may be recovered next year from the employees' wages. Of course, employers may not be able to recover the money with respect to employees who leave. Also, employers must address wage and hour issues. Employers choosing this approach should consult with legal counsel.

Alternatively, employers could continue to withhold the money and wait on the government to provide additional guidance. If Congress waives payment of the taxes, the money could be distributed to employees after the waiver is announced. If the government does not waive payment of the taxes, employers who choose this approach will have the money to pay the taxes. If employees ask questions, they could be told that it would be difficult for employees to pay the money in January in a lump sum. Because of the various complications, most employers will likely choose to continue to withhold the employee payroll tax.

Two forms of uncertainty exist regarding these developments. One is that the Administration will have to clarify and potentially revise some of the specifics. The other is that there may be litigation over the President's authority to take such sweeping executive actions. There is much irony in the important aspects of the President's executive actions, in that Democrats support many of the measures the President took, although they might have taken even more aggressive steps. Further, the Democrats may not want to be on record in opposing matters crucial to those adversely affected by the pandemic. There are even legal questions such as standing, as to what entity has a right to sue to stop the executive actions.

Thus, employers must decide whether to stop withholding the employee portion of such taxes effective September 1, 2020. It may be helpful to prepare a communication to employees that explains the program and its temporary nature. It is suggested that such a memo be issued as late as possible since additional guidance from the government may be received. In late August, the IRS said that employers deferring the taxes would have to pay the money back by April 2021, and possibly by doubling withholding for payroll taxes. The IRS does not address what employers should do if employees quit before the end of the year, although a possibility is to recoup the remaining taxes owed by withholding them from employees' final paycheck.

Related Content

Get Email Updates

Recent Content

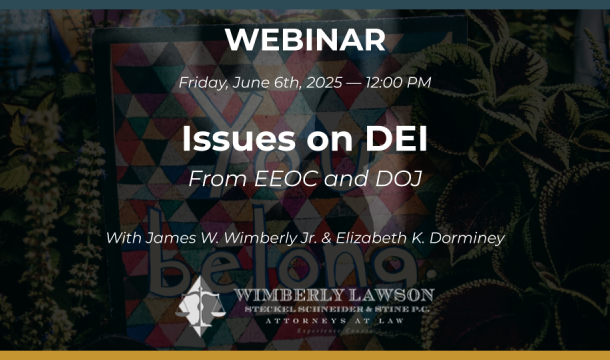

The EEOC and DOJ Issue Guidance on DEI

Considerations When Government Officials Show Up and Request to Meet with Individual Employees

How Jurors Evaluate the Fairness of an Employer’s Actions

Some of the Controversial Issues Currently Being Faced by Employers in Light of Recent Developments

Frequently Asked Questions About Recent Immigration-Related Actions