The $900 billion pandemic relief that passed Congress in December was a compromise measure aimed at improving economic recovery. Some of its most important features are as follows:

- The Bill provides $600.00 stimulus payments for individuals making up to $75,000.00 per year and $1,200.00 for married couples making up to $150,000.00 per year, as well as a $600.00 payment for each child dependent.

- Federal unemployment insurance benefits for COVID-19 will be extended to March 14, 2021, with a $300.00 supplement payment each week, similar to the extra $600.00 supplement that expired last July. The programs providing jobless benefits to those not traditionally eligible, like gig workers and the self-employed, are included. The Emergency Unemployment Compensation that provided up to 13 additional weeks of jobless benefits was extended as well.

- Business expenses paid for with forgiven PPP loans are deductible, in addition to the forgiveness being non-taxable income. There are also additional expenses that can qualify for forgiveness.

- Businesses are eligible for a second round of funding if they have 300 or fewer employees and can prove they experienced a 25% drop in revenue during one quarter of 2020 compared to the previous year.

- There is a continuation and expansion of the Employee Retention Credit. This allows PPP loan recipients to use the credit, increases the credit from 50% to 70% of qualified wages, with the cap on credit increased to $28,000.00. The business must experience more than a 20% reduction in gross receipts when comparing a calendar quarter to the same quarter in 2019, or from the immediately preceding quarter.

- There is an extension of refundable payroll tax credits for paid sick leave and family leave, through March 31, 2021. The mandated paid sick leave and family and medical leave ended on December 31, 2020, but employers may voluntarily provide the paid leave and take the tax credit associated with the leave taken through March 31, 2021. This would apply where an employee has not exhausted all of their paid sick leave, so that the covered employer might elect to voluntarily extend the employee’s deadline to use any remaining paid sick leave. The changes do not provide additional paid leave hours for 2021 if the employees have exhausted their paid leave in 2020. This means that offering these paid leave items after December 31, 2020 will become optional for employers. Further, an employee will no longer be entitled by law to take either emergency paid sick leave or emergency family and medical leave after December 31, 2020, even if they have a qualifying reason.

It should be noted that even though the required emergency paid sick leave and the emergency paid family leave provisions are not extended, employers must continue to comply with other laws providing employees with leave rights, such as the Family Medical Leave Act (FMLA), or potentially some state and local leave laws.

The recent pandemic relief bill signed by President Trump during December did not resolve partisan differences over a liability shield for employers wanted by some Republicans, and aid for state and local governments wanted by Democrats.

Questions? Need more information?

Call Jim Hughes (jlh@wimlaw.com) or Jim Wimberly (jww@wimlaw.com) at 404-365-0900.

Related Content

Get Email Updates

Recent Content

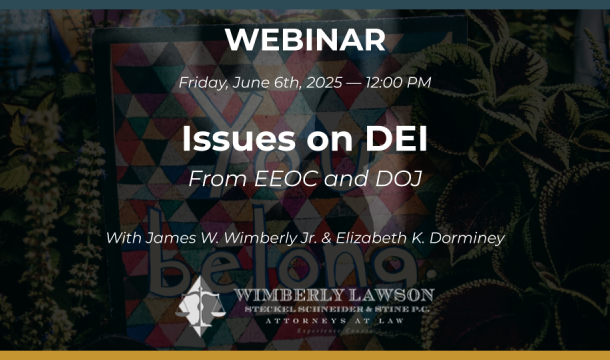

The EEOC and DOJ Issue Guidance on DEI

Considerations When Government Officials Show Up and Request to Meet with Individual Employees

How Jurors Evaluate the Fairness of an Employer’s Actions

Some of the Controversial Issues Currently Being Faced by Employers in Light of Recent Developments

Frequently Asked Questions About Recent Immigration-Related Actions